IR Information

IR Information

- TOP

- IR Information : Corporate information : Corporate Governance

Corporate Governance

Basic Concepts of Corporate Governance

We consider the strengthening of corporate governance to be a priority management issue in making a contribution to society as a good corporate citizen based on one of the objectives of “contributing to improvements in life and culture in local communities” set out in our Management Philosophy. We have introduced the independent officer system and became a company with an Audit and Supervisory Committee, and the execution of the duties by Directors is being supervised and audited by the Board of Directors and the Audit and Supervisory Committee. We will continue our efforts to heighten the transparency and fairness of our corporate management and increase corporate value for the benefit of shareholders and other stakeholders.

Company Motto

Management Philosophy

- 1.Contribute to improvements in life and culture in local communities

- 1.Bring employees happiness and develop human character

- 1.Work for co-existence and co-prosperity with business partners

- 1.Secure profits for growth and development of the Company

Basic Policy on Corporate Governance

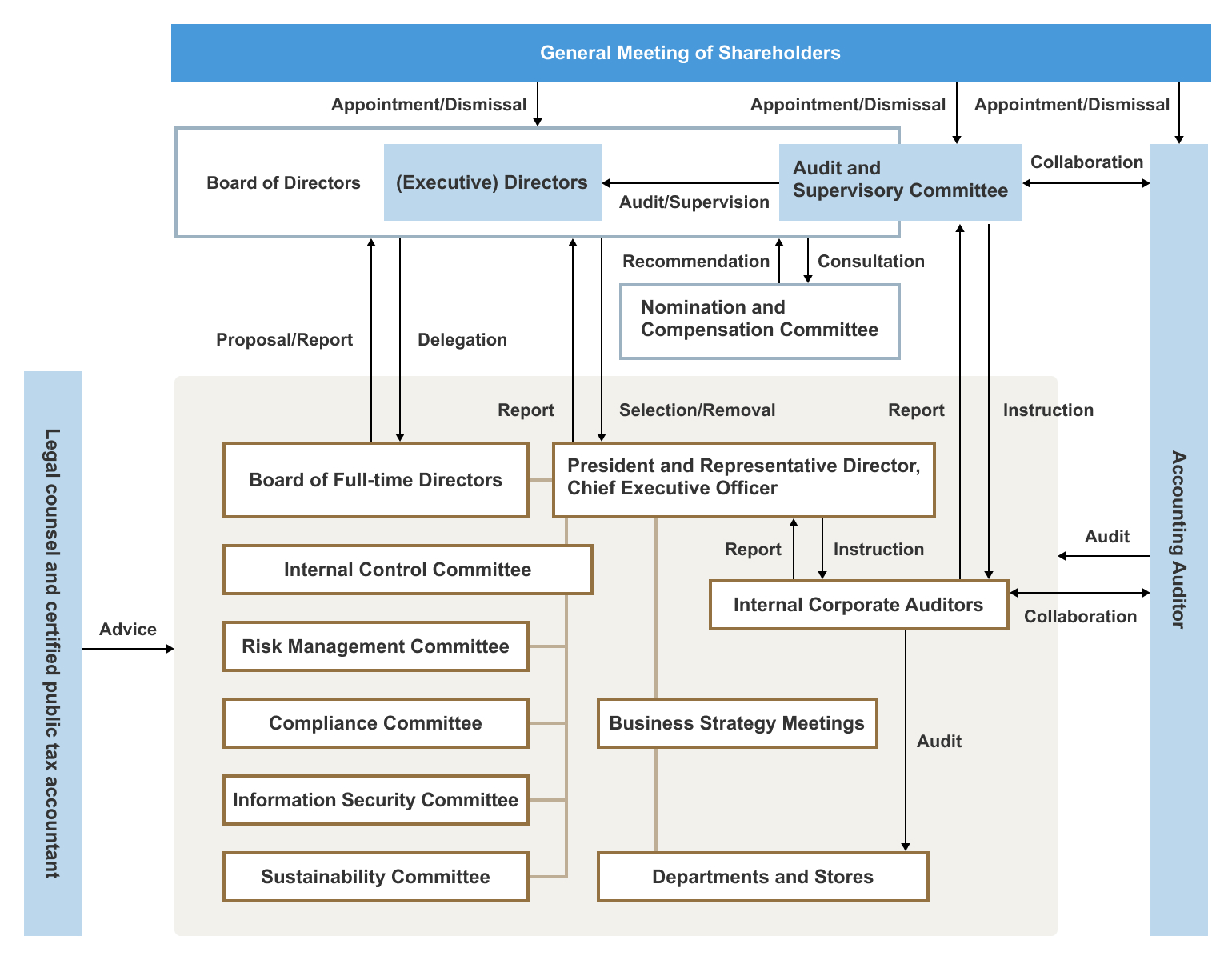

Basic Policy on Corporate GovernanceDiagram of Corporate Governance System

Overview of the Corporate Governance System

The Company has introduced an Audit and Supervisory Committee system as its corporate governance system. By complying with various laws and regulations, rules, and social norms, not to mention corporate laws and regulations, and by conducting business in a transparent and fair manner, we will broadly fulfill our corporate social responsibility (CSR), such as ensuring corporate stability and conforming to the social environment, and manage our business with the aim of becoming a company that can contribute to our customers and local communities. The Company has Directors (excluding Directors who are Audit and Supervisory Committee Members) and Directors who are Audit and Supervisory Committee Members. Notification that the Outside Directors are Independent Directors has been provided to the Tokyo Stock Exchange. The Company appoints experts as Outside Directors from the perspective of ensuring the legality and appropriateness of business execution.

1. Directors and the Board of Directors

Role

Board of Directors meetings are held once or twice a month to make decisions on important matters concerning business management and supervise the status of business execution. With respect to the execution of day-to-day operations, the Company has established a business promotion system in which Directors are assigned to key positions and necessary authority is delegated to them.

Balance, Diversity and Size of the Board of Directors as a Whole

The Company believes that the current number of the Board of Directors is appropriate for substantial and effective discussions on strategic agenda items set by the Company. The Board of Directors is comprised of members who have business experience and professional expertise and experience in multiple categories in consideration of the overall balance. Outside Directors in particular are those who have highly-specialized expertise and experience with due consideration to ensuring the sound and sustainable growth of the Company. In addition, female Directors are appointed, which exemplifies support for the diversity of the Company. In appointing Directors, upon discussions with the candidates, they are selected according to the criteria of whether they are capable of contributing to an increase in the corporate value of the Company. Upon discussion by the Nomination and Compensation Committee, the Board of Directors will submit the selection for approval at a General Meeting of Shareholders. In addition, guidelines pertaining to the appointment of Outside Directors are established and the criteria for determining the independence are disclosed in our securities reports and corporate governance reports.

2. Audit and Supervisory Committee Members and the Audit and Supervisory Committee

The Company has introduced the Audit and Supervisory Committee system. The Audit and Supervisory Committee consists of Members that are either a Full-time, Inside Member, a Full-time, Outside Member, or other Outside Members. The Audit and Supervisory Committee Members perform audits by attending Board of Directors meetings, Board of Full-time Directors meetings, Business Strategy Meetings and other important meetings, interviewing Directors, auditing stores, etc., based on the audit plan. Meetings of the Audit and Supervisory Committee are held once a month in principle, where the audit policy and audit plan are discussed and decided upon.

3. Nomination and Compensation Committee

The Nomination and Compensation Committee, consisting of Inside Directors and Outside Directors, meets as necessary. The Nomination and Compensation Committee is consulted by the Board of Directors, deliberates on the nomination of Directors and decisions on compensation, etc. for Directors other than Audit and Supervisory Committee Members, and reports the results to the Board of Directors.

4. Board of Full-time Directors

The Board of Full-time Directors consists of Full-time Directors, and Deputy General Managers appointed by the chairman according to agenda items. Meetings are held once a week in principle. The Board of Full-time Directors facilitates prompt management decision-making by making decisions on matters for resolution delegated by the Board of Directors, and supervises the status of business execution.

5. Business Strategy Meetings

The Company holds Business Strategy Meetings once a week in principle, aside from Board of Directors meetings and Board of Full-time Directors meetings, to discuss individual management issues. Business Strategy Meetings are attended by Inside Directors, Full-time Audit and Supervisory Committee Members, Executive Officers, and Deputy General Managers appointed by the chairman according to agenda items. They discuss important policies on business execution concerning management and the performance of operations, and Business Strategy Meetings are significantly utilized for prompt management decision-making.

6. Internal Control Committee

The Company regularly assesses risks at Internal Control Committee meetings to establish crisis management on a company-wide basis. In addition, the Internal Control Committee supervises the Compliance Committee, the Crisis Management Committee, the Committee for Response to the Japanese Sarbanes-Oxley (J-SOX) Act, and the Sustainability Committee.

7. Compliance Committee

The Company has put in place the Compliance Committee, the objective of which is to contribute to ensuring the appropriateness of operations and the soundness of management and the retention and improvement of credibility by formulating basic concepts on compliance and creating and maintaining a compliance system. Compliance Committee meetings are held once a month in principle to discuss and evaluate the status of compliance in overall operations from a company-wide perspective, thereby working to strengthen and improve the compliance system.

8. Crisis Management Committee

The Crisis Management Committee works on company-wide risk management and reviews the status of development and implementation of the crisis management system, among other efforts.

9. Committee for Response to the J-SOX Act

The Company has put in place the Committee for Response to the J-SOX Act for the purpose of ensuring the appropriateness of financial reporting and has been developing and implementing risk controls in important operational processes.

10. Sustainability Committee

The Company has put in place the Sustainability Committee to formulate its sustainability policy and achieve both the missions of tackling social issues and achieving corporate growth in order to realize a sustainable future. The Sustainability Committee collaborates with the Board of Directors to determine measures to promote sustainability and monitor related initiatives on a company-wide basis. Regarding initiatives to address climate change, the Sustainability Committee determines policies, shares information among departments on the Company’s environment-related status including emission volumes for CO₂ and other greenhouse gases, monitors company-wide progress, and reports to the Board of Directors, among other efforts.

IR Information

- Dear shareholders and investors

- Financial Results and Highlights

- Corporate information

- Stock Information

- IR library